By Atfinance

Introduction

In a world of economic uncertainty, rising inflation, fluctuating interest rates, and growing financial complexity, managing your assets effectively has never been more critical. Whether you’re a high-income professional, a business owner, or planning for retirement, partnering with a trusted wealth management company can significantly enhance your financial well-being.

Canada is home to a wide array of firms specializing in wealth management, each offering varying levels of service, strategy, and expertise. But how do you know which one is right for you? What distinguishes the best wealth management companies from the rest in 2025?

In this in-depth guide, we’ll explore what wealth management truly means, why it matters now more than ever, and what specific qualities to look for in a firm that will help you preserve, grow, and transfer your wealth wisely.

What Is a Wealth Management Company?

A wealth management company provides comprehensive financial planning, investment advice, tax optimization, estate planning, and risk management for individuals, families, and sometimes businesses. Unlike traditional financial advisors who focus on single areas like investments or insurance, wealth management firms deliver an integrated, long-term strategy that covers all aspects of your financial life.

Core services typically include:

-

-

- Financial planning

- Investment management

- Tax-efficient strategies

- Retirement planning

- Estate and succession planning

- Insurance and risk mitigation

- Trust and legal advisory (via partners)

-

The goal is simple: align your financial resources with your life goals, so your wealth not only grows—but supports your vision for the future.

Why More Canadians Are Turning to Wealth Management in 2025

1. Economic volatility requires strategic decisions

With interest rates fluctuating, stock markets reacting to global events, and the housing market under pressure, DIY investing or “set-it-and-forget-it” approaches are no longer sufficient. Canadians are realizing the value of expert guidance to navigate complexity.

2. Increasing personal wealth in certain segments

A growing number of Canadians—especially in cities like Montreal, Toronto, and Vancouver—are building significant assets through real estate, entrepreneurship, and long-term investing. As their financial profiles grow, so does the need for structured planning.

3. A generational wealth transfer is underway

An estimated $1 trillion will be transferred between generations in Canada over the next decade. Wealth management firms are becoming essential to ensure smooth, tax-efficient transfers and avoid legal complications.

4. New investment vehicles and regulations

From crypto-assets and private equity to evolving tax rules, there’s a clear demand for professionals who can keep up with changes and adapt strategies accordingly.

The 6 Key Qualities of Top Wealth Management Companies

1. Holistic and personalized approach

Top-tier firms don’t offer cookie-cutter solutions. Instead, they begin with a deep analysis of your financial situation, life goals, risk tolerance, and family needs. They build a customized roadmap that evolves with you.

They ask questions like:

-

-

- What do you want your money to do for you?

- When do you want to retire?

- Are you planning to support your children’s education?

- Do you own a business or rental properties?

- What legacy do you want to leave behind?

-

2. Fee transparency and flexible compensation models

Top firms clearly explain how they’re paid:

-

-

- Fee-only: Transparent, based on time or services.

- Percentage of assets under management (AUM): Typically 0.5% to 1%.

- Hybrid: A mix of flat fees and performance-based incentives.

-

Avoid companies that are vague or push commission-based products without full disclosure.

3. Robust investment strategy

Great wealth management companies:

-

-

- Use evidence-based, diversified investment strategies

- Rebalance portfolios regularly

- Optimize taxation of returns

- Align investments with your risk tolerance and goals

- Provide regular performance reports

-

They also educate clients, helping you understand the reasoning behind each decision.

4. Integration of technology and reporting tools

In 2025, real-time access to your financial data is a must. Leading firms offer:

-

-

- Secure online portals and mobile apps

- Performance dashboards

- Document vaults

- Personalized financial modeling and simulations

-

This ensures transparency, control, and peace of mind.

5. Long-term relationship and ongoing support

Wealth is not static. As your life evolves, so should your financial plan. The best firms provide:

-

-

- Regular check-ins

- Proactive adjustments

- Strategic updates aligned with tax law changes or life events

-

They treat the relationship as a partnership—not a transaction.

Top 5 Most Influential Wealth Management Companies in Canada (2025)

-

-

- RBC Wealth Management – https://www.rbcwealthmanagement.com

A leading global provider, RBC offers tailored wealth strategies, a strong focus on succession planning, and extensive research-backed investment options. - BMO Private Wealth – https://www.bmo.com/wealth

Known for its holistic approach, BMO integrates banking, investment, tax, and estate solutions—ideal for high-net-worth families and entrepreneurs. - Scotia Wealth Management – https://www.scotiawealthmanagement.com

Scotiabank’s wealth arm provides Total Wealth Planning and expert advisory teams for investment, legal, and philanthropic goals. - Richardson Wealth – https://www.richardsonwealth.com

An independent firm offering personalized financial advice with a fiduciary focus and access to cutting-edge investment research and platforms. - National Bank Financial Wealth Management – https://www.nbfwm.ca

Strong in Quebec and across Canada, NBFWM excels in personalized portfolio management, financial planning, and bilingual services.

- RBC Wealth Management – https://www.rbcwealthmanagement.com

-

These firms are recognized for their national reach, multi-generational planning strategies, and sophisticated investment management tools.

You don’t need to work only with big-name firms to get outstanding service. While large institutions provide global reach and deep resources, smaller or local advisors often bring unmatched personal attention, flexibility, and responsiveness.

Smaller firms typically build long-term relationships, offer more direct communication, and tailor strategies without being constrained by big-bank bureaucracy. If you’re unsure, just check the satisfaction levels shown in local Google reviews. For example, our palmarès of the top-rated wealth management companies in Laval proves that boutique advisors are earning consistent five-star ratings from clients who value trust, clarity, and personalized care.

Most Appreciated Wealth Management Companies in Laval (Based on Google Reviews)

Each of the following companies has a verified 5-star rating on Google:

-

-

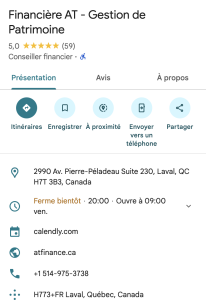

- AT Finance – Google Maps

A standout for its client-first approach, bilingual service, and tech-savvy platform, AT Finance is a trusted choice for professionals and families looking for tailored financial strategies.

- Groupe Financier Horizons – Laval – Google Maps

Known for its commitment to long-term client relationships, Horizons offers personalized wealth planning, risk management, and insurance services with an attentive and friendly team.

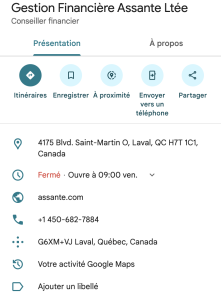

- Gestion de patrimoine Assante Laval – Google Maps

Part of a nationally recognized brand, Assante Laval delivers structured wealth planning and investment management backed by a network of experienced advisors.

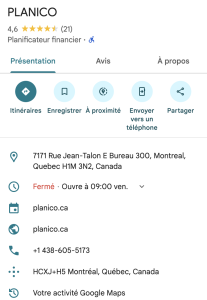

- Services Financiers Planico Inc. – Google Maps

Highly rated for responsive service and simplified explanations, Planico is ideal for clients seeking clarity and structure in their financial planning journey.

- AT Finance – Google Maps

-

These local firms may not be the biggest names in Canada, but their 5-star reviews reflect their real strength: building close, trusted relationships with clients. For many individuals and families, smaller firms offer more direct access, personalized strategies, and faster response times compared to large institutions.

At AT Finance, we offer a modern, client-first approach to wealth management—tailored to Canadian individuals, families, and business owners.

What sets us apart?

-

-

- ✔️ Personalized wealth strategies, not templates

- ✔️ Certified advisors with expertise in investment, tax, insurance, and estate planning

- ✔️ Bilingual service (English & French)

- ✔️ Local presence in Montreal, with clients across Quebec and Ontario

- ✔️ Transparent fees and no hidden commissions

- ✔️ Use of cutting-edge financial technology for easy access and updates

-

Whether you’re looking to build wealth, protect what you’ve earned, or pass it on to future generations, AT Finance provides the clarity, structure, and support you need.

📞 Schedule your free consultation and discover how we can help you build a secure, purposeful financial future.

Frequently Asked Questions (FAQs)

1. What is the difference between a financial advisor and a wealth manager?

A financial advisor may focus on one area (like investments), while a wealth manager offers a full-service approach including estate, tax, and retirement planning.

2. Are wealth management services worth it?

Yes, especially if you have complex needs or significant assets. They can help you optimize taxes, grow wealth, and avoid costly mistakes.

3. How do I choose a good wealth management company?

Look for certified advisors, fee transparency, strong reviews, and a personalized approach aligned with your goals.

4. What fees do wealth management companies charge?

Fees can vary from flat fees to a percentage of AUM (typically 0.5%-1%). Always ask for full disclosure.

5. Is my money safe with a wealth manager?

If the firm is regulated by IIROC or AMF and uses custodians for assets, your money is generally safe and insured.

6. Does AT Finance offer bilingual service?

Yes, we provide services in both English and French across Quebec and Ontario.

7. Can I get wealth management remotely in Canada?

Absolutely. Most top firms now offer secure online meetings, dashboards, and communication tools.

8. What are some signs of a bad wealth management firm?

Lack of transparency, no certifications, aggressive product pushing, and poor communication are red flags.

9. Do I need to be wealthy to use wealth management?

Not necessarily. Many firms have entry points for professionals or families building wealth over time.

10. What should I bring to my first meeting with a wealth manager?

Bring financial statements, investment summaries, insurance policies, and a list of goals or concerns to discuss.

Want more insights? Contact AT Finance for a no-obligation consultation and get expert support for your financial future.